Enhance Your Structure: Proficiency in Trust Foundations

Enhance Your Structure: Proficiency in Trust Foundations

Blog Article

Securing Your Properties: Count On Structure Knowledge within your reaches

In today's complicated financial landscape, guaranteeing the safety and security and development of your properties is vital. Count on foundations offer as a foundation for safeguarding your wide range and tradition, offering an organized technique to asset defense.

Value of Count On Structures

Depend on foundations play a critical function in establishing credibility and cultivating solid connections in numerous expert setups. Building trust fund is vital for businesses to flourish, as it forms the basis of successful cooperations and partnerships. When trust fund is present, people really feel much more certain in their interactions, bring about enhanced performance and efficiency. Depend on structures work as the foundation for moral decision-making and transparent communication within companies. By focusing on count on, services can develop a positive work culture where staff members really feel valued and respected.

Advantages of Expert Support

Structure on the foundation of count on specialist relationships, seeking specialist advice provides invaluable benefits for people and companies alike. Specialist guidance offers a riches of expertise and experience that can aid navigate complex monetary, legal, or critical obstacles effortlessly. By leveraging the know-how of specialists in numerous areas, people and companies can make informed decisions that align with their goals and goals.

One considerable advantage of specialist advice is the capacity to accessibility specialized expertise that might not be conveniently offered otherwise. Professionals can use understandings and point of views that can result in ingenious services and opportunities for growth. In addition, functioning with specialists can assist alleviate dangers and uncertainties by providing a clear roadmap for success.

Furthermore, specialist support can save time and resources by streamlining procedures and preventing costly mistakes. trust foundations. Specialists can use customized guidance customized to certain requirements, ensuring that every choice is knowledgeable and strategic. On the whole, the advantages of expert advice are diverse, making it a valuable property in securing and making best use of possessions for the long term

Ensuring Financial Protection

Making certain monetary protection entails a complex strategy web link that incorporates numerous facets of riches administration. By spreading investments across various property classes, such as stocks, bonds, real estate, and commodities, the risk of substantial economic loss can be alleviated.

Furthermore, preserving an emergency fund is necessary to guard versus unforeseen expenses or income disturbances. Professionals suggest reserving three to six months' well worth of living expenses in a fluid, easily obtainable account. This fund works as a monetary security web, giving assurance during stormy times.

Routinely evaluating and adjusting economic plans in feedback to altering circumstances is additionally critical. Life occasions, market changes, and legislative adjustments can impact economic stability, emphasizing the significance of recurring assessment and adjustment in the pursuit of long-lasting financial safety - trust foundations. By implementing these approaches thoughtfully and constantly, people can fortify their monetary ground and work towards an extra secure future

Securing Your Properties Properly

With a solid foundation in place for financial security through diversity and emergency situation fund upkeep, the following essential action is securing your possessions efficiently. One effective strategy is property appropriation, which entails spreading your investments across numerous property classes to reduce threat.

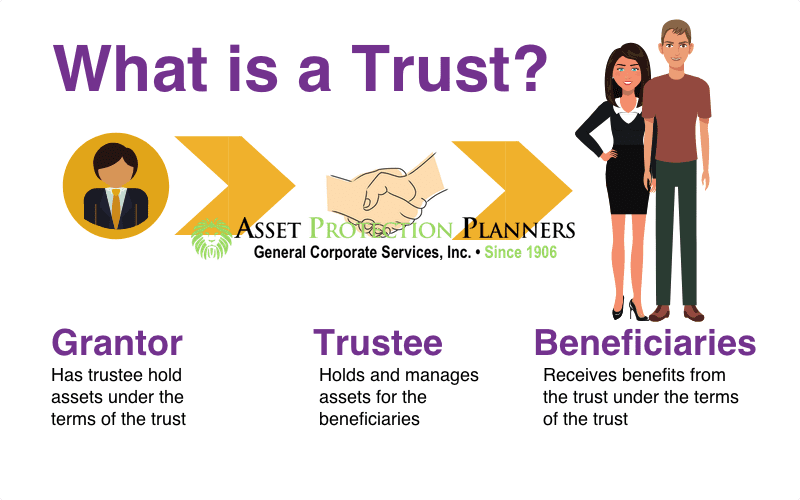

In addition, establishing a depend on can supply a secure method to shield your assets for future generations. Counts on can assist you regulate just how your assets are distributed, lessen inheritance tax, and protect your riches from lenders. By applying these strategies and seeking professional guidance, you can secure your possessions properly and safeguard your monetary future.

Long-Term Property Defense

To make certain the lasting security of your wealth against potential risks and unpredictabilities over time, strategic preparation for lasting property security is necessary. Lasting possession security includes executing steps to this post safeguard your assets from numerous hazards such as financial recessions, suits, or unanticipated life occasions. One vital element of long-term property defense is establishing a count on, which can offer substantial advantages in shielding your properties from lenders and legal disputes. By transferring possession of possessions to a trust fund, you can safeguard them from potential threats while still maintaining some level of control over their monitoring and circulation.

Additionally, expanding your investment profile is an additional essential approach for long-term possession security. By spreading your financial investments across different possession courses, industries, and geographical regions, you can decrease the effect of page market variations on your overall wealth. Furthermore, regularly examining and upgrading your estate strategy is essential to guarantee that your possessions are shielded according to your dreams in the lengthy run. By taking a proactive method to long-term possession security, you can secure your wide range and give economic security for yourself and future generations.

Verdict

In final thought, trust foundations play an essential duty in protecting properties and guaranteeing economic safety and security. Specialist assistance in developing and managing depend on frameworks is important for lasting asset security.

Report this page